In a surprising move, the Reserve Bank of India (RBI) has declared the withdrawal of the ₹2000 denomination currency notes from circulation. This decision has sparked widespread discussions and concerns among the public regarding the exchange process and the deadline for depositing these notes. In this article, we will provide you with all the essential details regarding the ₹2000 note ban, including how to exchange these notes at the bank and the last date for depositing them.

2000Rs Note Ban News

Contents

- 1 2000Rs Note Ban News

- 2 2000 Note Ban Demonetisation Overview

- 3 RBI Announces Withdrawal of ₹2000 Banknotes from Circulation

- 3.1 Rs 2000 Note Ban in India

- 3.2 Declining Circulation

- 3.3 RBI Rs 2000/- Note Ban in India : Highlights

- 3.4 What’s the Reasons for Withdrawal of 2000 Rupees Note?

- 3.5 What happens next after 2000rs note Ban in india?

- 3.6 Why did RBI withdraw Rs 2000 notes from circulation?

- 3.7 How many Rs 2000 notes are currently in circulation?

- 4 The ₹2000 Note Ban

- 5 Last Date for Depositing ₹2000 Notes

- 6 How to Exchange ₹2000 Notes?

- 7 RBI Notice for Rs 2000 Note Ban PDF

- 8 Rs 2000 Note Ban 2023 FAQs

The Reserve Bank of India (RBI) has announced the discontinuation of the ₹2000 note in India starting from May 19, 2023. People who possess these notes can exchange them at their nearest bank for other legal tender. The ₹2000 note will remain legal tender until September 30, 2023, and individuals can deposit a maximum of ₹20,000 at a time. Multiple exchanges are allowed by visiting the branch where you hold an account. This post provides all the necessary information about the ban, including instructions for depositing and the maximum deposit limit. Please ensure that you are familiar with the new rules regarding the validity and last date for depositing ₹2000 notes.

2000 Note Ban Demonetisation Overview

| News | Rs 2000 Note Ban in India |

| Dept. Name | Reserve Bank of India |

| Reason of Rs 2000 Note Ban | Purpose Resolved |

| Rs 2000 Demonetisation Notification | 19 May 2023 |

| Implemented From | 19 May 2023 |

| Bank Deposit | 23 May 2023 |

| Last Date to Deposit | 30 September 2023 |

| Where to Deposit | Bank and RBI Regional Office |

| Maximum Deposit Allowed | Rs 20000/- in One Time |

| Total Money in Circulation | Rs 6.73 Lakh Crore |

| Cash Deposit through Vending Machine | No Guidelines |

| Article Category | Finance News |

| Official Website | rbi.org.in |

RBI Announces Withdrawal of ₹2000 Banknotes from Circulation

The RBI has decided to withdraw the ₹2000 banknotes from circulation. While they will remain legal tender, no new ₹2000 notes will be issued. This decision is based on the fact that the ₹2000 banknotes have served their purpose, and other denominations now meet the currency needs of the economy.

Rs 2000 Note Ban in India

The RBI has decided to implement the demonetization of ₹2000 notes in India. Citizens who possess these notes can deposit them at banks starting from May 23, 2023. The introduction of the ₹2000 note was aimed at balancing the demand and scarcity of other legal tender currencies. Deposited notes will be accepted and valid in the market. As per the rules, individuals can deposit a maximum of 10 ₹2000 notes, totaling up to ₹20,000. Multiple deposits and exchanges are allowed. Notably, there are no guidelines regarding depositing notes in cash machines, so it is possible to deposit a larger number of notes using them. The decision to withdraw ₹2000 notes was announced on May 19, 2023, and the deposit window begins on May 23, 2023, with the last date for depositing ₹2000 notes being September 30, 2023.

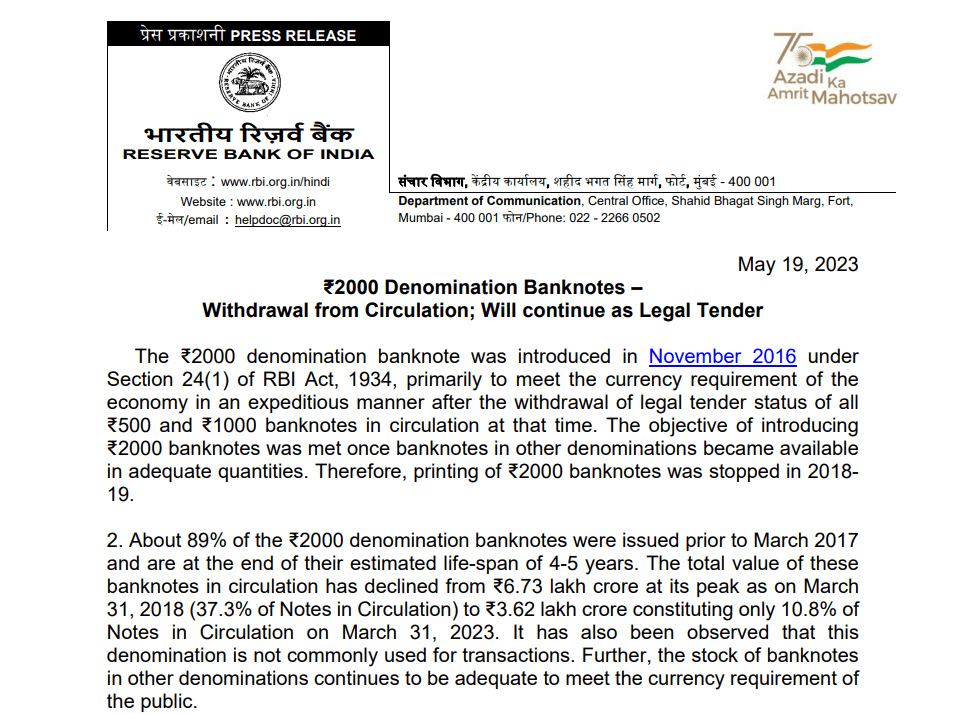

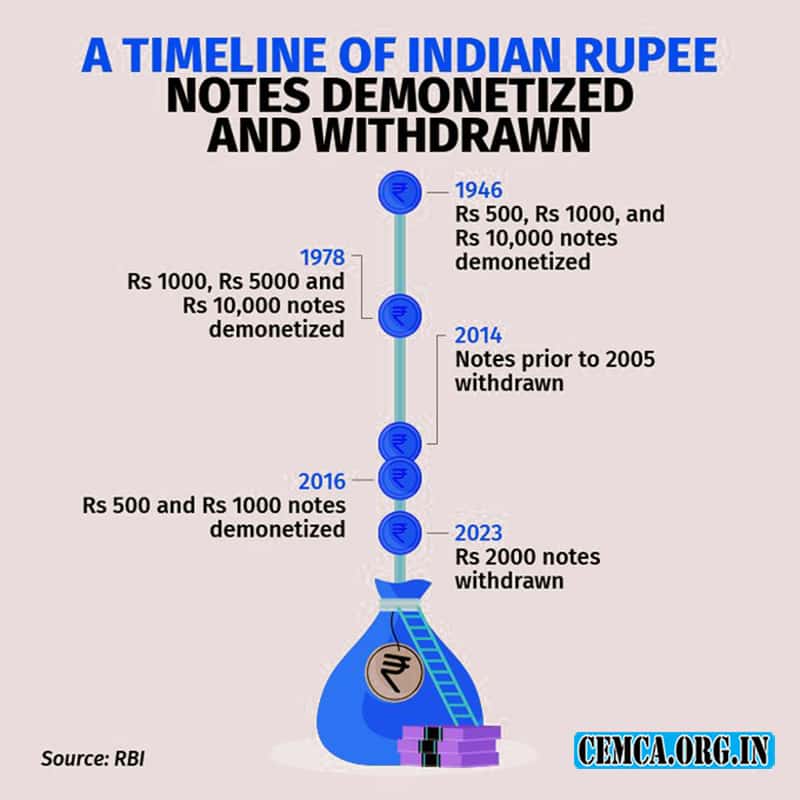

Declining Circulation

The circulation of ₹2000 banknotes has declined significantly over the years. Around 89% of these banknotes were issued before March 2017 and have now reached their estimated lifespan of 4-5 years. As a result, the total value of ₹2000 banknotes in circulation has decreased from ₹6.73 lakh crore at its peak on March 31, 2018, to ₹3.62 lakh crore. Currently, ₹2000 banknotes constitute only 10.8% of the total notes in circulation as of March 31, 2023. This decline in circulation, coupled with limited usage, played a significant role in the decision to withdraw the ₹2000 banknotes.

RBI Rs 2000/- Note Ban in India : Highlights

- RBI issued a notice on May 19, 2023, regarding the withdrawal of ₹2000 notes.

- Citizens are required to return ₹2000 notes to the bank by September 30, 2023.

- The decision was made to introduce smaller legal tender, and the ₹2000 note served as a temporary requirement.

- Notes can be deposited until September 30, 2023, with a maximum value of ₹20,000 at a time.

- The new rules for depositing notes differ from the previous demonetization process.

What’s the Reasons for Withdrawal of 2000 Rupees Note?

The ₹2000 banknotes were introduced in November 2016 to address the sudden withdrawal of ₹500 and ₹1000 banknotes as legal tender. These new notes were meant to meet the urgent currency demands during that period. However, the printing of ₹2000 banknotes was stopped in 2018-19 since their intended purpose had been achieved. Additionally, the RBI observed that the usage of ₹2000 banknotes for everyday transactions was not widespread.

What happens next after 2000rs note Ban in india?

According to the RBI, the banknotes in the Rs 2000 denomination will remain legal tender. All banks are mandated to provide deposit and/or exchange facilities for Rs 2000 banknotes until September 30, 2023. This means that individuals can continue to use and exchange Rs 2000 notes without any restrictions until the specified date.

Why did RBI withdraw Rs 2000 notes from circulation?

The RBI has noted that approximately 89% of the Rs 2000 banknotes were issued before March 2017 and have reached their estimated lifespan of 4-5 years. The total value of these notes in circulation has decreased from ₹6.73 lakh crore at its peak on March 31, 2018 (representing 37.3% of total notes in circulation) to ₹3.62 lakh crore, constituting only 10.8% of total notes in circulation as of March 31, 2023. It has also been observed that the Rs 2000 denomination is not commonly used for transactions. Moreover, the stock of banknotes in other denominations is deemed sufficient to meet the currency requirements of the public.

How many Rs 2000 notes are currently in circulation?

The denomination of Rs 2000 currently comprises approximately 181 crore notes, with a total value of Rs 3.62 lakh crore. These notes account for approximately 10.8% of the total currency notes in circulation in India. The value of Rs 2000 notes has decreased from its peak of Rs 6.73 lakh crore on March 31, 2018.

The ₹2000 Note Ban

On 19th May 2023, the RBI officially announced the withdrawal of ₹2000 currency notes as part of its monetary policy measures. The primary objective behind this move is to address concerns of black money, counterfeit currency, and to facilitate better circulation of currency in the economy. It is important to note that the withdrawal of the ₹2000 notes does not affect the validity of other currency denominations.

Last Date for Depositing ₹2000 Notes

The RBI has set a deadline for depositing ₹2000 notes, and it is crucial to be aware of this date to avoid any inconvenience. As of the current information available, the last date for depositing ₹2000 notes is 30th Sept 2023. Ensure you visit the banks before this deadline to exchange your notes.

- The last date to exchange ₹2000 notes in India is September 30, 2023.

- Banks will begin the exchange process from May 23, 2023.

- In a single visit, you can exchange a maximum of ₹20,000 worth of notes.

- The notice does not specify an upper limit for cash deposits through vending machines.

- The ₹2000 note will continue to be accepted as legal tender in shops, markets, and malls.

₹2000 Note Maximum Deposit Limit

- The maximum deposit limit for Rs 2000 notes is Rs 20,000 at a time.

- Banks, post offices, and RBI regional offices will facilitate the exchange of Rs 2000 notes.

- Multiple deposits are allowed on different days, and you can exchange notes exceeding the maximum value.

- You have the option to deposit the notes or exchange them for Rs 500, Rs 100, or Rs 200 notes.

- The validity of the notes will remain until September 30, 2023, and you can also exchange them after this date.

CNG Pump Dealership Advertisement

Can 2000rs notes be used anywhere after September 30, 2023?

While the RBI has stated that Rs 2000 notes can be exchanged in banks until September 30, 2023, it is unclear whether they will continue to be legal tender beyond that date. Many people are seeking clarification from the RBI regarding the status of these notes post the specified deadline. It is advisable to stay updated with official announcements from the RBI for any clarifications or changes regarding the legal tender status of Rs 2000 notes after September 30, 2023.

How to Exchange ₹2000 Notes?

If you possess ₹2000 notes, you can exchange them at any designated banks. The RBI has instructed all banks to facilitate the exchange process smoothly. To exchange your ₹2000 notes, follow these steps:

- Visit a Bank: Go to your nearest bank branch that offers currency exchange services.

- Carry Identification: Bring a valid identification document, such as Aadhaar card, PAN card, or passport, along with your ₹ 2,000 notes.

- Fill out Forms: Fill out the required forms provided by the bank for currency exchange. Provide the necessary details, including your name, address, and bank account information.

- Hand over the Notes: Present your ₹ 2,000 notes to the bank officials for verification.

- Provide Reason: If asked, provide a valid reason for the exchange, such as the need for smaller denomination notes or any other legitimate purpose.

- Receive New Currency: After the verification process, the bank will provide you with new currency notes of smaller denominations or credit the equivalent amount to your bank account.

- Keep Receipts: Ensure to obtain a receipt or acknowledgement for the transaction as proof of exchange.

Remember to adhere to the specified deadline for exchanging the ₹ 2,000 notes, as announced by the RBI. It is recommended to contact your bank for any specific instructions or requirements regarding the currency exchange process.

What if a bank refuses to exchange ₹2000 notes?

To address any complaints, customers should initially contact the concerned bank. If the bank does not respond within a month or if the customer is dissatisfied with the resolution provided, they can file a complaint under the Reserve Bank – Integrated Ombudsman Scheme, 2021. The complaint can be filed through the complaint management system portal of RBI, which can be accessed at cms.rbi.org.in. This platform allows customers to escalate their grievances and seek resolution through the RBI’s complaint redressal mechanism.

Facilities for senior citizens, persons with disabilities to exchange notes

Banks will be making special arrangements to ensure a smooth process for senior citizens, persons with disabilities, and other vulnerable individuals who wish to exchange or deposit Rs 2000 notes. These arrangements are aimed at minimizing any inconvenience or difficulties faced by these individuals during the exchange or deposit process. The specific details of these arrangements may vary from bank to bank, so it is advisable to contact the respective bank to inquire about the special facilities available for such customers.

RBI Notice for Rs 2000 Note Ban PDF

| RBI Notice Rs 2000 Note Ban PDF | Check Here |

| Official Website | Visit Website |

Rs 2000 Note Ban 2023 FAQs

When is the RBI Rs 2000 Note Ban implemented?

Effective from May 19, 2023, the RBI has implemented a ban on the Rs 2000 note in India.

How to Exchange Rs 2000 Note in India?

To exchange your Rs 2000 note, visit the nearest bank. They will assist you in the process of exchanging the note for other legal tender currency.

What is the Last Date to Exchange Rs 2000 Note?

You have the opportunity to exchange your Rs 2000 note until September 30, 2023. Ensure that you visit a bank or authorized exchange center before the specified deadline to complete the exchange process.

What is the Maximum Exchange Limit of 2000 Rupees Note?

The maximum exchange limit for the Rs 2000 note is Rs 20,000, which equates to a maximum of 10 notes of Rs 2000 each. Please note that this limit applies to a single transaction or visit to the bank. If you have more than 10 notes, you can make multiple visits to exchange them.

is 2000 Rupees Exchange Process Start in my city?

if the exchange process for Rs 2000 notes has started in your city, you can check with your local bank branch. They will have the most up-to-date information regarding the availability and commencement of the exchange process. You can also refer to official announcements from the Reserve Bank of India (RBI) or visit their website for any notifications regarding the exchange process in your city.

Related Articles

फार्म मशीनरी बैंक खोलने पर मिलेगी 80% की सब्सिडी, जाने कैसे?